Deposits held in the EU banks and smart withdrawal options

Your comfort for any deposits or withdrawal represent priority for us. Therefore, we offer the possibility to make deposits to your trading account in certain ways, like bank transfer, use of payment card or payment by using e-wallet. Your deposited funds are then stored safely in European banks. At the same time, you may choose between the accounts held in EUR, USD, GBP and CZK.

Security of deposits and insurance against bankruptcy

Within our regulation across the whole European Union, we are approved to provide innovative forex broker services. We are registered with all the local regulators such as FCA, BaFin, ACPR, AFM, CONSOB, KNF and more. All of the deposited funds of traders and investors are furthermore segregated from the company funds, which secures the safety of your whole deposited amount. Retail clients’ deposits are insured against company bankruptcy up to the amount of 20,000 EUR. as a part of the Investors Compensation Fund.

Deposits and withdrawals via wire transfer

We always care about your withdrawals to be processed within one business day. The cheapest and most common way of deposits is via wire transfer. We understand our clients and their urgency of having the money available as soon as possible. For 100% security of your funds, it is possible to withdraw your funds only to the bank account from which we received the deposit. Bank details are automatically imported into PurpleZone after a deposit so you can apply for withdrawal at any time with just a few clicks. We accept clients’ deposits only in a form of noncash payments. We only accept deposits from bank accounts held under your name. Deposits made from banks regulated outside the EU or third-party deposits (including companies offering exchange services) cannot be accepted and will be returned to the sender at their own expense.

DEPOSIT FEES

| Bank | Domestic transfer in CZK | SEPA transfer in EUR | International transfer |

| PPF bank | Free of charge | 100 CZK (cca 4 EUR) | 300 CZK (cca 14 USD) |

| UniCredit Bank SK | - | 0.27 EUR | 0.5 % (min 10 EUR, max 100 EUR) |

| Sparkasse Malta bank | - | Free of charge | 0.1 % (min 10 EUR, max 150 EUR) |

WITHDRAWAL FEES

| Bank | Domestic transfer in CZK | SEPA transfer in EUR | International transfer |

| PPF bank UniCredit bank SK Sparkasse Malta bank |

2 CZK | 0.15 EUR | 14 USD/11 GBP |

Deposits and withdrawals via credit/debit cards

Besides the bank wire you can also use credit or debit cards for deposits (Visa, MasterCard®). The limits range from 15 to 9,999 EUR.

When making a deposit by a card over the limit of 2,000 USD/EUR/GBP it is necessary to fill out a form as a confirmation of the deposit before we can add the funds to your trading account. This document can be found after a deposit in PurpleZone, where you can upload it immediately, or we will ask you to confirm it by e-mail as soon as possible.

In the event of card deposits, it’s necessary to submit scanned card. This could be attached directly in the PurpleZone when performing first deposit to make the entire procedure faster. The scanned copy should show only the name, expiration date, the first six and last four digits on the front, and signature on the back. For clients’ reassurance, all other details should be concealed. From the moment your card is approved, all your deposits will be reflected to your account automatically. However, please pay a close attention to correctly fill out your full name as the cardholder when making a deposit.

In case you deposited funds by card, it is necessary to refund the initial deposit to the same card in the same currency first. The possible remaining profit can then be withdrawn via bank transfer.

Instructions on how to correctly make a deposit can be found in your client zone, the PurpleZone.

Deposits from Prepaid cards are not accepted. Our payment provider is TrustPay, a.s. Authorised and Regulated by the National Bank of Slovakia.

Fees for credit card deposits (for free until the end of 2019)

Deposits and withdrawals by using the Neteller and Skrill e-wallet

The deposit amount is limited by the amount of USD 5,000 (or equivalent sum in any other currency) within one calendar month. Withdrawals of funds with the use of an e-wallet are accepted by us only in case the deposit to trading account was made in the same way. Deposits with prepaid Skrill or Neteller cards are not permitted!

Deposit instructions may be found in PurpleZone under “Deposit/Withdraw“.

DEPOSIT FEES VIA NETELLER, SKRILL

Deposit (Neteller, Skrill): for free until the end of 2019

Withdrawal (Neteller): 2% of withdrawn amount – USD 30 maximum (or equivalent in another currency)

Withdrawal (Skrill): 1% of the withdrawn amount

Be where "human to human" approach is a reality

Your Capital is at Risk.

Professional client's account

Something extra

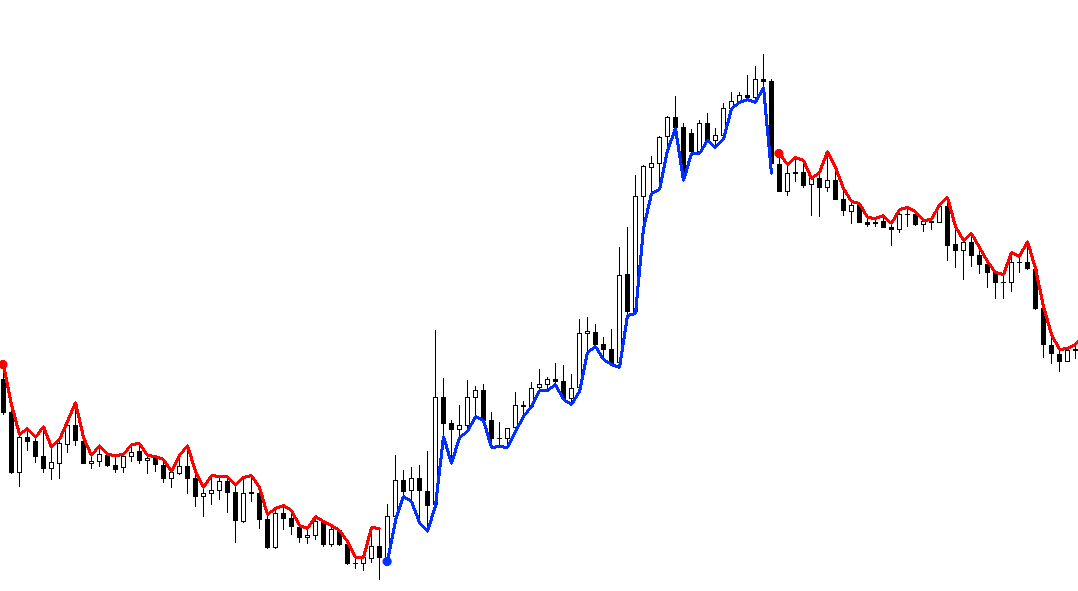

Purple Strike indicator. Download our unique indicator for free!