What are cryptocurrencies?

Cryptocurrencies are virtual currencies which operate independently of commercial and central banks or governments. In spite of this, they can be exchanged and traders can speculate on changes in their exchange rates, just like with traditional physical currency.

Even though there are currently hundreds of different cryptocurrencies on the market, for the time being we offer our clients the possibility to trade CFDs for four of the most popular: Bitcoin, Litecoin, Ethereum, Bitcoin Cash and Ripple.

What is the difference between trading on cryptocurrency exchanges and cryptocurrency CFD trading?

| Cryptocurrency exchanges | Cryptocurrency CFD trading with Purple Trading |

|---|---|

| You buy cryptocurrencies directly through an exchange and you own them | You buy cryptocurrencies virtually without owning them |

| You can either hold the cryptocurrencies on the exchange, or put them in your own virtual or physical wallet | You don’t own the cryptocurrencies, so you don’t need to worry |

| In the event of cryptocurrency sell-offs, you will have to send the cryptocurrency from your wallet back to the exchange and wait for the counterparty | You can trade at any time and anywhere (as long as you have an internet connection) |

| In the event of a cryptocurrency hard fork, you are also entitled to the new version | With a cryptocurrency CFD, you do not receive a new version of the cryptocurrency after a hard fork |

| On the other hand, cryptocurrency exchanges are frequently hacked or robbed, meaning that their users can lose the cryptocurrency they keep on a stock exchange. There is also the danger of a wallet itself being hacked | No such risk exists with a cryptocurrency CFD |

| Cryptocurrency stock exchanges are currently overwhelmed with public interest, so setting up and approving an account can take weeks | At Purple Trading, as long as you send the verification documents and information correctly, we will open your account in 1 business day after registration |

| Only a handful of small exchanges are regulated in the EU. The rest are often unregulated or operate in tax havens | Purple Trading is an EU Brokerage firms that cooperates with EU regulated Investments Firms for execution of orders |

| On most cryptocurrency exchanges, it is not possible to short on cryptocurrency price | With a cryptocurrency CFD, you can speculate on both rises and falls |

| On exchanges, you can even buy small fractions of a cryptocurrency. This can be even in the range of several decimal points easily. Most of the time, however, you can’t use financial leverage | The minimum size of a trade with a cryptocurrency CFD at Purple Trading is 0.01 lots, or a hundredth of a contract. But you can use financial leverage at a ratio of 2:1 |

| Much of the time, it is relatively expensive to get your funds in a traditional currency onto an exchange itself. Exchanges often impose charges of more than 5% for a deposit or withdrawal, while bank transfers to foreign countries can take over a week | At Purple Trading, we naturally give priority to deposits and withdrawals and, thanks to a bank account kept here in the Czech Republic, bank transfers only take one business day. For card deposits, our payment gateway charges only 1.59% and for withdrawals back onto the card, a fixed fee of CZK 54 is charged. Please visit our website for more details here |

| Trading on exchanges is cheaper and you do not pay charges for holding the cryptocurrency on the exchange or in a wallet | Compared to the exchanges, CFD trading is more expensive and you have to pay fees for keeping your trading positions open overnight as well, a so-called swap |

| If you anticipate long-term growth of a cryptocurrency, you can keep it on a stock exchange or in a wallet for as long as you like | At Purple Trading, cryptocurrency CFDs always expire on Friday evening, so you can never stay in one position for more than 5 days |

Risks related to trading CFDs on cryptocurrencies (also known as ‘virtual currencies’)

Prior to trading CFDs on cryptocurrencies you should be aware of the following:

- These products are complex and high risk and as such come with a high risk of losing all the investment capital.

- The value of these products can widely fluctuate and may result to a significant loss over a short period of time.

- These products are not appropriate for all investors and for this reason you should not trade in such products, unless you have the necessary relevant knowledge and experience and you fully understand the specific characteristics and risks related to them.

- Please make sure that you carefully read the clauses related to cryptocurrencies in our Terms and Conditions and ensure that you fully understand the risks associated with trading CFDs on cryptocurrencies.

Be where "human to human" approach is a reality

Try Demo Account

Open Real Account

Your Capital is at Risk.

Professional client's account

Something extra

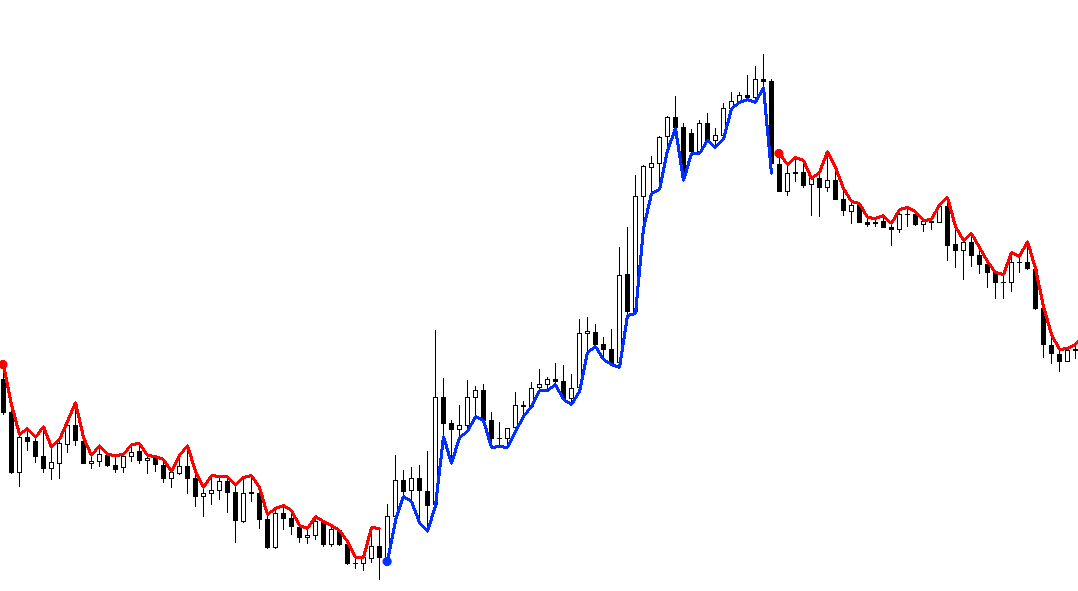

Purple Strike indicator. Download our unique indicator for free!